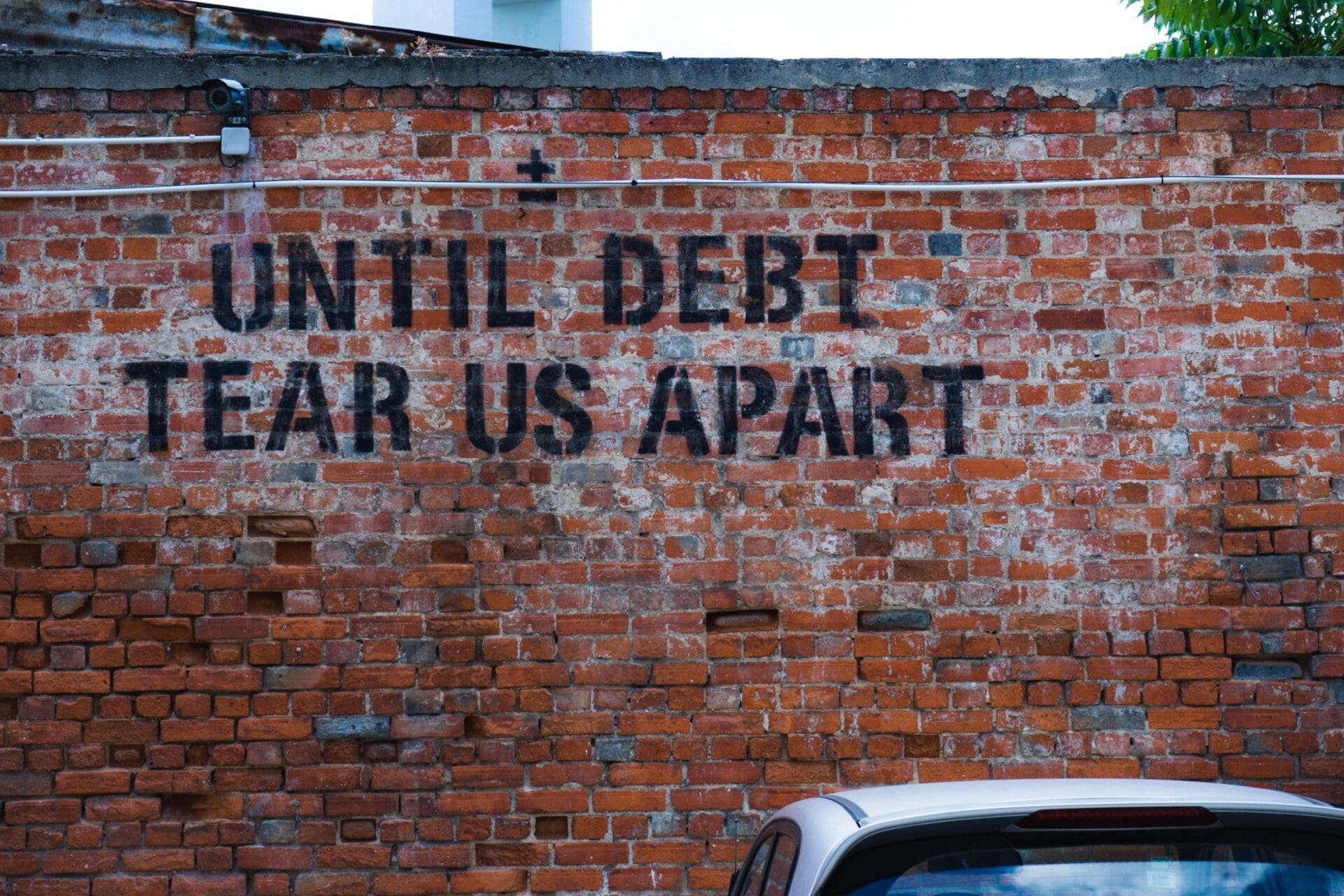

Short-term loans, often called “payday loans”, are typically advertised as perfect for those with bad credit, who may not qualify for personal loans from traditional lenders like banks or credit unions. However, payday loans are dangerous for a variety of reasons. Borrowers should take caution before using this option. Image via Unsplash/Ehud Neuhaus Continue to...

Payday loans are a popular way to get cash fast, but they are notorious for their high interest rates and tendency to plunge consumers into a never-ending cycle of debt. They are a solution of last resort and personal finance experts warn against them strongly. However, are there instances when they make sense? Read on...

Your favorite stores offer credit cards, national companies offer enticing perks and credit cards can be used just about anywhere. So, how many should you really have? While there’s no magic number, here are a few things to consider before you add another card to your wallet. Image via Unsplash/Two Paddles Axe and Leatherwork Continue...

A low credit score can hold you back from accomplishing your goals. Luckily, you may be able to raise you score by 100 points or more by following these seven tips. The best part is these changes can make a positive impact on your score quickly. Read on to learn more. Image via Unsplash/Brooke Cagle...

Credit cards can be useful financial tools when used properly, but users can also get into financial trouble easily if they misuse them. Check out these tips to follow to ensure you’re being smart about your credit card use and avoiding costly mistakes. Image via Unsplash/Joshua Rawson-Harris Continue to original source.

If you subscribe to the “out of sight, out of mind” view of your credit score, you’re not alone. However, you could be setting yourself up for financial trouble down the road. Ignoring this all-important indicator of your financial wellness can negatively impact you in many ways. Read on for five specific reasons you should...

If you’re looking to be free from your debts sooner rather than later, there are tactics you can use to pay your loans off faster. Although they work for any type of loan, they’re particularly useful in gaining freedom from your personal loans. Read on to learn how to speed up your loan payment timeline....

Do you subscribe to an “out of sight, out of mind” view of your credit score? If so, you could be setting yourself up for financial trouble down the road. Ignoring this all-important indicator of your financial health can negatively impact you in many ways. Read on for five specific reasons you should never ignore...

Using a credit card responsibly can be a great way to establish a positive credit history. Starting to think about your credit while in college will pay off down the road when you want to make a major purchase like a home, so check out these credit cards that are perfect for college students. Image...

Personal loans are a type of unsecured credit that is generally very flexible. In fact, you can use them for a multitude of reasons, both planned and unplanned. Click through to learn six common reasons people opt to use personal loans for their expenses. Image via Unsplash/@jinyun Continue to original source.