Small business owners at one point or another will find themselves in a place where they’ll need to run a credit check on a potential customer, even if it feels a bit uncozy. But it’s a relatively simple process. You just sign up for a free account through Experian as a small business owner and...

For those who need to improve their finances, there are a few things you can do to get your finances straightened out. Stick to a pre-set budget. Keep your will updated. Review your insurance coverage regularly. Pay off debt as quickly as possible. Put money into retirement and savings.

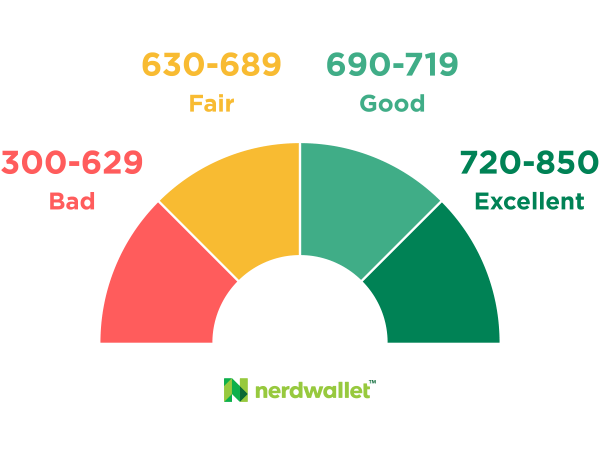

For people that are looking to get a personal loan even though their credit score isn’t “excellent,” there’s still hope. Nerd Wallet rated the following the best options for “good” credit score holders: LightStream Marcus by Goldman Sachs Payoff SoFi Best Egg LendingClub Discover Personal Loan

Each year, you’re allowed to do one hard credit report request to make sure your credit score is in a strong place. You can do that through the following steps: Visit: annualcreditreport.com Call: 1-877-322-8228 Mail a form to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

If you want to get a first credit card, you’ll want to make sure you keep in mind some tips for keeping your credit score low. You can do this by making sure you pay off your balance each month when possible and you don’t skip any monthly payments. Also, use your credit score to...

If you’re looking at a credit card bill, you’ll notice that there’s always a minimum payment recommended. That’s right. It’s not the amount that you need to pay–it’s just a recommendation of what you should at least pay (you can’t pay less than that amount, essentially). If you have the means to do so, pay...

By keeping a strong credit score and making sure your driving record stays as clean as possible, you will be on your way to a lower auto insurance rate. You can also do things like changing around your billing schedule so that it isn’t monthly installments or by increasing your deductible so your monthly premiums...

Some cardholders are noticing that their credit card companies are lowering their credit line, which could negatively affect their credit scores. This is due to the current coronavirus pandemic. As unemployment rates soar in the United States, card issuers want to make sure people can make their payments and won’t incur too much debt that...

If you’re going to take out student loans to help you pay for college, you’ll likely be deciding between private or federal loans. Here’s what you’ll need to know about federal loans. They can often have lower interest rates than private loans. They’re issued by the Department of Education and have multiple options. You don’t...

If you recently got your first credit card, here are some tips to keep in mind. Check your statements regularly. Track your payments so you don’t go into debt. Don’t hit your credit limit. Pay each bill in full every month if possible. Use your points.